CeFi (Centralized Finance) has been a significant force in the market since the invention of cryptocurrencies, simplifying trading and storing funds. The beginning of the broader adoption of cryptocurrencies was an excellent opportunity to learn about them and make the first transactions in a secure, easy-to-understand virtual environment. DeFi (Decentralized Finance) is a relatively recent invention. Its popularity continues to grow with the number of applications the projects create, offering the world more and more interesting solutions to complex financial problems. What are the differences between DeFi and CeFi? What are their advantages, and why is decentralization so important? Find out in the article!

What is CeFi?

Centralized Finance is a combination of blockchain-based solutions with a central institution coordinating their operation. These institutions are usually CEX (centralized exchange) lending platforms, e.g., Binance, Coinbase, Bybit, Kraken, Gemini, and Kucoin. They act as middlemen in transactions, storing funds on their platform, securing them, and providing liquidity. In addition to CEX trading, they enable lending, borrowing, and margin trading. On the operational side, they are characterized by: ease of use, 24/7 support, forced KYC/AML verification, the ability to buy crypto by fiat, and the most crucial aspect — storing your funds on the platform’s wallets.

What is DeFi?

Decentralized Finance is a sub-domain of blockchain based on operating without any intermediaries. Instead, smart contracts automatically perform the transactions when certain conditions are met. It is a field of finance that implements the original premise of blockchain as an anonymous and permissionless space. DeFi is also characterized by transparency, control, and accessibility. No intermediary has possession of your funds — you have to be responsible for their safety yourself. The rules of operation of financial instruments are clear, and funds are traceable. DeFi is compatible with the solutions CeFi offers, such as loans, leveraged trading, decentralized managed voting, and stablecoin, and the number of instruments continues to grow.

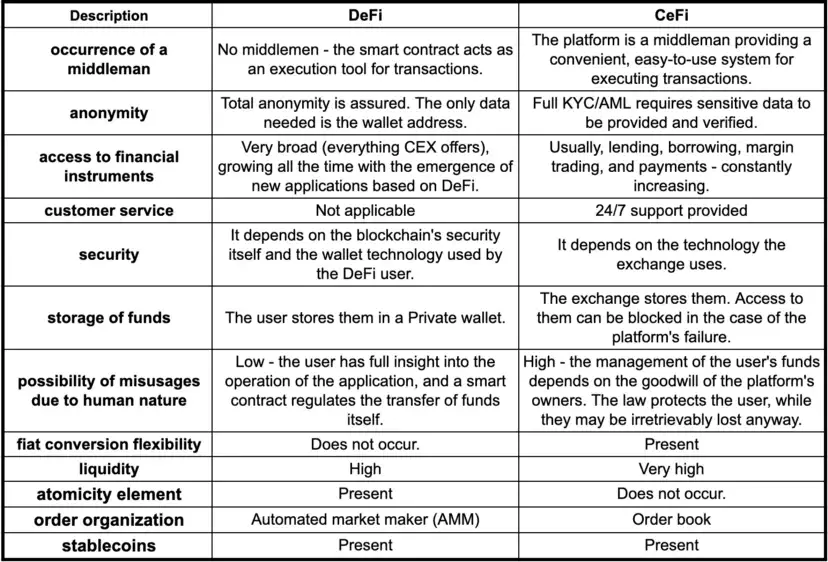

DeFi vs. CeFi — learn the difference

Below, you will find a table with the differences between Centralized and Decentralized Finance:

Advantages o CeFi

Below you will find the advantages that set CeFi apart. It will give you a better understanding of how centralized finance works.

Cross-chain services

On CeFi, you can trade coins issued on other blockchain platforms, such as LTC, BTC, or XRP. DeFi does not support these tokens, which do not meet interoperability standards. Cross-chain exchanges are complicated and time-consuming. CeFi circumvents this problem by obtaining custody of funds from other chains.

Transaction costs

CeFi services are usually much cheaper than using DeFi using gas, the price of which depends on many factors. These are discussed in the Maximal Extractable Value article.

Fiat-crypto conversion

DeFi services do not offer to purchase cryptocurrencies for fiat currencies. To purchase bitcoin, for example, you must first buy it on CeFi platforms

Order execution

CeFi platforms have strict procedures regarding the order and cost of executing transactions. Every customer is treated as an equal. In DeFi, there is no supervisor to regulate the addition of new transactions to the block, which translates into a lot of abuse by validators or miners who want to maximize their reward in various ways.

Advantages of DeFi

Having learned the benefits of CeFi, let’s now look at the advantages of DeFi.

Atomic transactions

A transaction in blockchain allows for sequential actions, which can involve several financial transactions simultaneously. Making it atomic means that all transactions will succeed or none will. This attribute is widely present in DeFi while enforcing such contracts in CeFi is costly and slow.

Permissionless and inclusivity

Anyone with a crypto wallet and the Internet can access DeFi’s services and move their assets anonymously. Decentralized finance works 24 hours, seven days a week. They operate in real-time, and interest rates are updated every minute.

Transparency

Transactions are public. Other users verify each, along with the address and wallets that took part in it. The data is stored in the blockchain.

Open-source API

Many projects created on DeFi are open-source. Everyone has access to the source code, which is why the operation of the application is transparent, unlike CeFi, where entrusting one’s funds to the exchange depends on the user’s trust.

No trade manipulation

Centralized platforms can disable trading in a given asset when the transactions performed may excessively affect the change of its price. In DeFi, such situations do not occur.

In conclusion — why should we pay attention to decentralization?

With the increasing adoption of cryptocurrencies, decentralization is becoming the driving force of the modern digital reality, giving finances anonymity and security. In the era of money printing and rampant inflation, building safe havens where resources are deflationary, and no central authority can influence your finances is the key to achieving personal freedom. DeFi solutions are a great way to use the full potential of blockchain. They connect with centralized finance, solving their problems and improving operations. Bridges are emerging that connect CeFi to DeFi, such as Syntetix, which allows CeFi financial instruments to be traded as DeFi derivatives. Chainlink transports data from CeFi, Grayscale Bitcoin Trust, which enables BTC to be traded on the CeFi over-the-counter market or Binance Bridge 2.0 that connect Ethereum-based tokens (both listed and unlisted) as B-Tokens to the BNB Chain. Over time, these two worlds will intertwine more and more, creating a synergy effect.

If you’re in search of a team with expertise in Web3 and blockchain development, don’t hesitate, to contact us.

Written for BlockyDevs

We power your Web3 future

We are a team of experienced blockchain enthusiasts who are more than willing to help you on your way to Web3. We provide end-to-end blockchain solutions for enterprises and ambitious startups. Let's create your future Web3 success together.